VAT REDUCTION – VAT REDUCTION ON 1ST JULY

INITIAL INFORMATION AND CHECKLIST

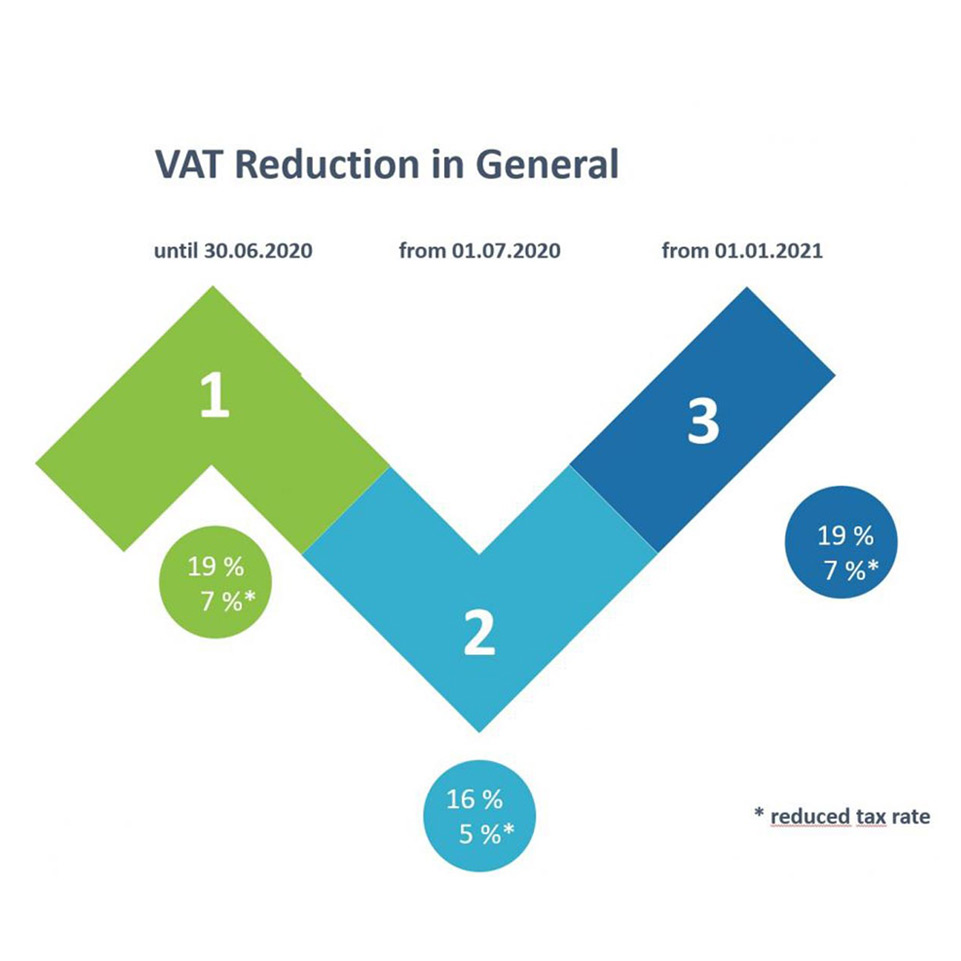

As part of its economic stimulus and crisis management package, the governing coalition has reduced the VAT rate from 19 % to 16 % and from 7 % to 5 % respectively from 1 July 2020 to 31 December 2020. At first glance, this is pleasing for the economy. As with taxes as a whole, but especially with VAT, it is the details of implementation that will not make it all that easy. And by 1 January 2021 you will have to go the reverse route back to the “old” VAT.

So here are the first details, practical examples and a To-Do-List – in the coming weeks there will certainly be more and more new information and hopefully clarifications.