One thing is clear: the biggest challenge at present is to find a suitable property. Once you have found it, it usually has to be done quickly. Because the next interested party is not far away. In order to speed up the decision on the required financing, you should act according to plan:

For the financing it is expected that you pay a part of the purchase price out of your equity. To do this, you must put together immediately available funds such as bank deposits, building society savings, securities (e.g. shares, bonds and funds) and other funds (e.g. current surrender values of life and pension insurance policies).

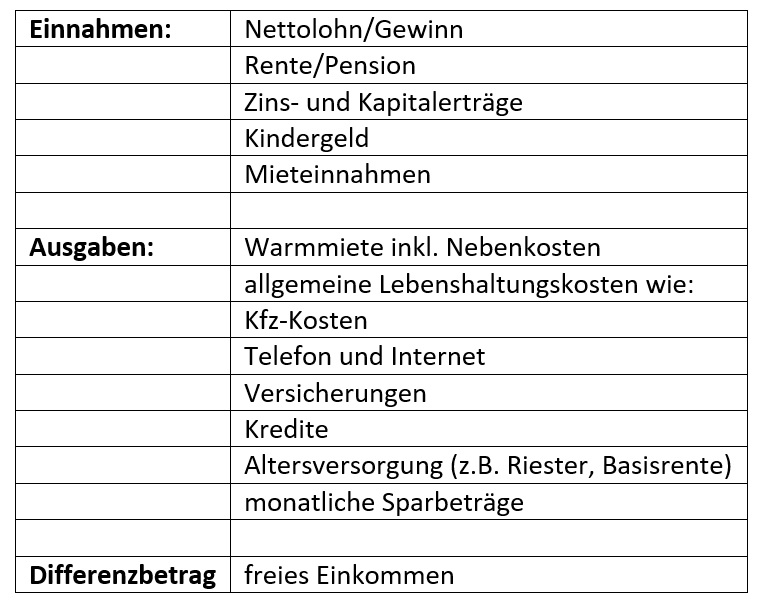

The second step is to determine the income available for loan repayment. As you can see in the table on the left.

n addition to the purchase price for the property, there are other costs. These are, on the one hand, ancillary purchase costs such as notary costs, brokerage fees, land transfer tax, interest during construction, building insurance and registration costs.

When buying a used property, the expected renovation and modernisation costs must be taken into account. In addition, 20% of the purchase price should be set aside for unforeseen costs.

The cost of setting up a property for own use is one of the most underestimated items. A new bed, a new coach, painting or wallpapering the walls, new lamps and a few extravagant accessories for the hallway are just a few examples. It often gets really expensive when furnishing the kitchen and the bathrooms. Here you should not calculate too tightly. Depending on taste and style, the cost of furnishing a detached house can quickly increase the total financial outlay by 50%.

After you have determined the expected costs, deduct the amount of immediately available funds that you would like to use as your own contribution to the purchase. The remaining amount must be financed. The expected annuity may not exceed the free income.

Our tip:

So that you know in which price range you can finance your dream property, simply calculate backwards: Determine your free income and the immediately available funds. On this basis, calculate the maximum property price.

But not only the financial feasibility should help you to make a decision. There are also other aspects that you should consider.

1. Can you afford the property?

Rule of thumb: A mortgage loan should be repaid by the time you reach retirement age at the latest.

2. Is the apartment building more suitable for me as an investment than the condominium, or should I invest in a commercial property?

The condominium is certainly easier to finance as an initial investment. The advantage of a multiple dwelling is that the administrative effort per square meter is lower. You also avoid possible conflicts with a community of owners.

The differences between tenant types can also be decisive.

3. Is the capital investment profitable?

The expected resale value must be at least equal to the purchase price plus incidental acquisition costs.

4. Does it make sense for me to use the condominium myself in my old age?

When choosing the property, the consideration of planning it as a retirement home can play a role. It is also worth comparing whether you will earn more than the cost of your own apartment when you rent it out.

5. How high is the property tax in the municipality concerned?

When choosing a location, it is worth making enquiries about the amount of property tax. This varies from state to state and from municipality to municipality. Property prices in the neighbouring municipality may also be lower.

6. Can I save taxes with the property?

In this case, it is decisive whether the property is used by the owner or whether a rental is planned. Is it a new or used property? Are apartments rented out or commercial premises etc.?

We will be happy to answer this question for you personally and individually.